vehicle personal property tax richmond va

WWBT - If you live in Chesterfield County you may have noticed a spike in personal property taxes especially when it comes to your car. All types of vehicles are currently taxed at 4 in terms of tax rates.

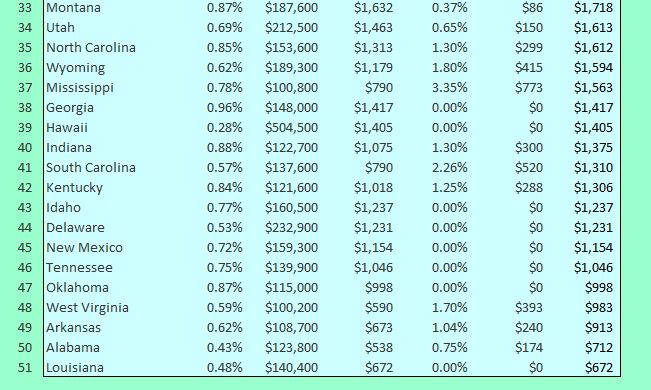

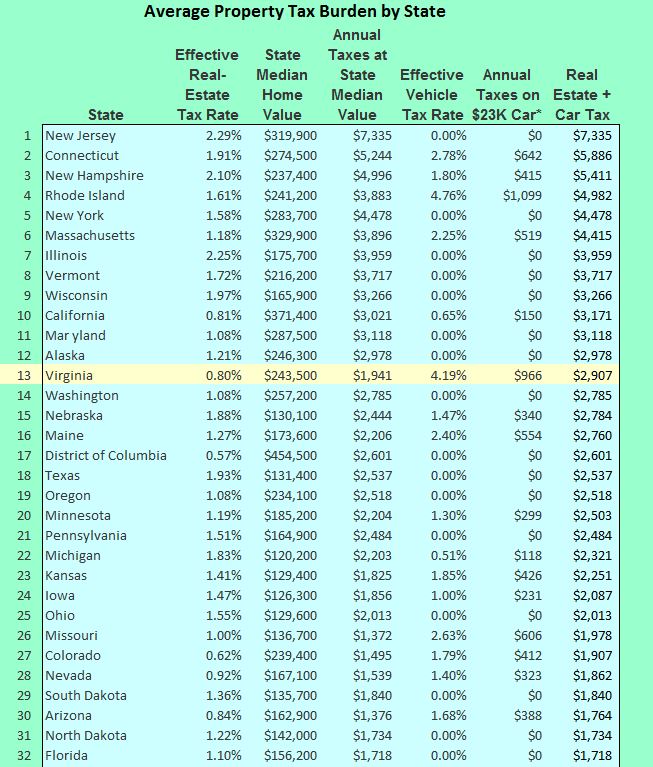

Soaring Home Values Mean Higher Property Taxes

Is more than 50 of the vehicles annual mileage used as a business.

. Many residents called 12 On Your Side and. The vision of the Richmond City Treasurers Office is to resurrect a greater sense of purpose between the Richmond banking industry and the Central Virginia community at large by expanding the knowledge understanding and self-reliance of individuals and their personal finances. Personal Property Tax Relief 581-3523.

To visit the site register your alarm or make a payment visit Cry Wolf. Personal Property Tax. Personal Property Taxes.

Answer the following questions to determine if your vehicle qualifies for personal property tax relief. Team Papergov 1 year ago. Parking tickets can now be paid online.

City Treasurer Armstead and Deputy Treasurer Morris. As used in this chapter. In this example if the vehicle were purchased on March 15 the property tax due date for the taxes on this vehicle would be June 5.

The owners of vehicles that qualify for property tax relief PPTR receive a full or partial exemption on the first 20000 of assessed value of the vehicle. It is an ad valorem tax meaning the tax amount is set according to the value of the property. WRIC Henrico County has announced plans to slash this years personal property tax by over 50 cents citing an unexpected surge in car.

Personal Property Registration Form An ANNUAL filing is required on all. Pay Your Parking Violation. The county also can consider high mileage and damage beyond regular wear and tear in assigning values to vehicles.

To contact customer service regarding questions about your false alarm bill call toll-free 1-877-893-5267. The total tax is 5 percent 4 percent state and 1 percent local A seller is subject to a sales tax on gross receipts derived from retail sales or leases of taxable tangible personal property. The Commissioner of the Revenue is responsible for assessing personal property taxes VA Code Sec 581-3100-31231.

If a vehicle is subject to the taxes in Alexandria for a full calendar year the tax amount is determined by multiplying the tax rate by the assessed value. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. Call 804 646-7000 or send an email to the Department of Finance.

However property taxes on a vehicle purchased or moved into Richmond after March 1 would be due 60 days from the date of purchase or the date the vehicle acquires situs in the City of Richmond. In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons.

2 days agoFor example the current personal property tax rates in Henrico Hanover and Chesterfield counties for vehicles are 350 357 and 360 respectively per 100 of assessed value. Click Here to Pay Parking Ticket Online. Real Estate and Personal Property Taxes Online Payment.

In this June 2017 image cars and trucks head west on I. Distributors do not pay tax on items purchased for resale. A higher-valued property pays more tax than a lower-valued property.

Is more than 50 of the vehicles annual mileage used as a business expense for federal income tax purposes OR reimbursed by an employer. Parking Violations Online Payment. Commissioner of the revenue means the same as that set forth in 581-3100For purposes of this chapter in a county or city which does not have an elected commissioner of the revenue commissioner of the revenue means the officer who is primarily responsible for assessing motor vehicles for the.

Personal Property Tax also known as a car tax is a tax on tangible property - ie property that can be touched and moved such as a car or piece of equipment. Other Useful Sources of Information Regarding False Alarm Fees. May 6 2022 0304 PM EDT.

Personal Property taxes are billed annually with a due date of December 5 th. Manufacturers do not pay tax on purchases used for production. If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief.

The 10 late payment penalty is applied December 6 th. My office has used the same assessment methodology for at least 35 years. Personal Property Taxes are billed once a year with a December 5 th due date.

Failure to receive a tax bill does not relieve you of the penalty and the interest on a past due bill. If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief. How Much Is Personal Property Tax On A Car In Virginia.

Interest is assessed as of January 1 st at a rate of 10 per year. If you have questions about your personal property bill or would like to discuss the value. City Code - Sec.

Qualifying vehicles with an assessed value of 1000 or less receive a full exemption from the personal property tax. Cars and trucks head west on I-95I-64 in downtown Richmond Friday June 30 2017.

![]()

Aba Tax Services Xero Accountant Property Business And S M S F Specialists Business Insurance Small Business Insurance Car Insurance

Virginia Property Tax Calculator Smartasset

Sales Tax How Sales Tax Is Calculated Pipedrive

Property Taxes How Much Are They In Different States Across The Us

021 The Pillars Of Fi Financial Independence Financial Independence Retire Early Smart Money

Pay Online Chesterfield County Va

Virginia Property Taxes Not As Bad As Jersey But Worse Than D C Bacon S Rebellion

28 Key Pros Cons Of Property Taxes E C

Dream Of Homeownership Slides Across The Uk Home Ownership New Home Developments Home

Virginia Property Taxes Not As Bad As Jersey But Worse Than D C Bacon S Rebellion

Youngkin Signs Bill To Reclassify Certain Vehicles And Personal Property Tax Rates Wric Abc 8news

Trulia Mortgage Center Goes Live Agbeat Mortgage Amortization Calculator Mortgage Loans Mortgage

How To Lower Property Taxes 7 Tips Quicken Loans

Aba Tax Services Xero Accountant Property Business And S M S F Specialists Business Insurance Small Business Insurance Car Insurance

26 States That Won T Tax Your Social Security This Year Main Street Maine Michigan